The future of IFRS compliance

Easily fulfil and manage complex IFRS requirements for providing compliant financial statement using latest technology available.

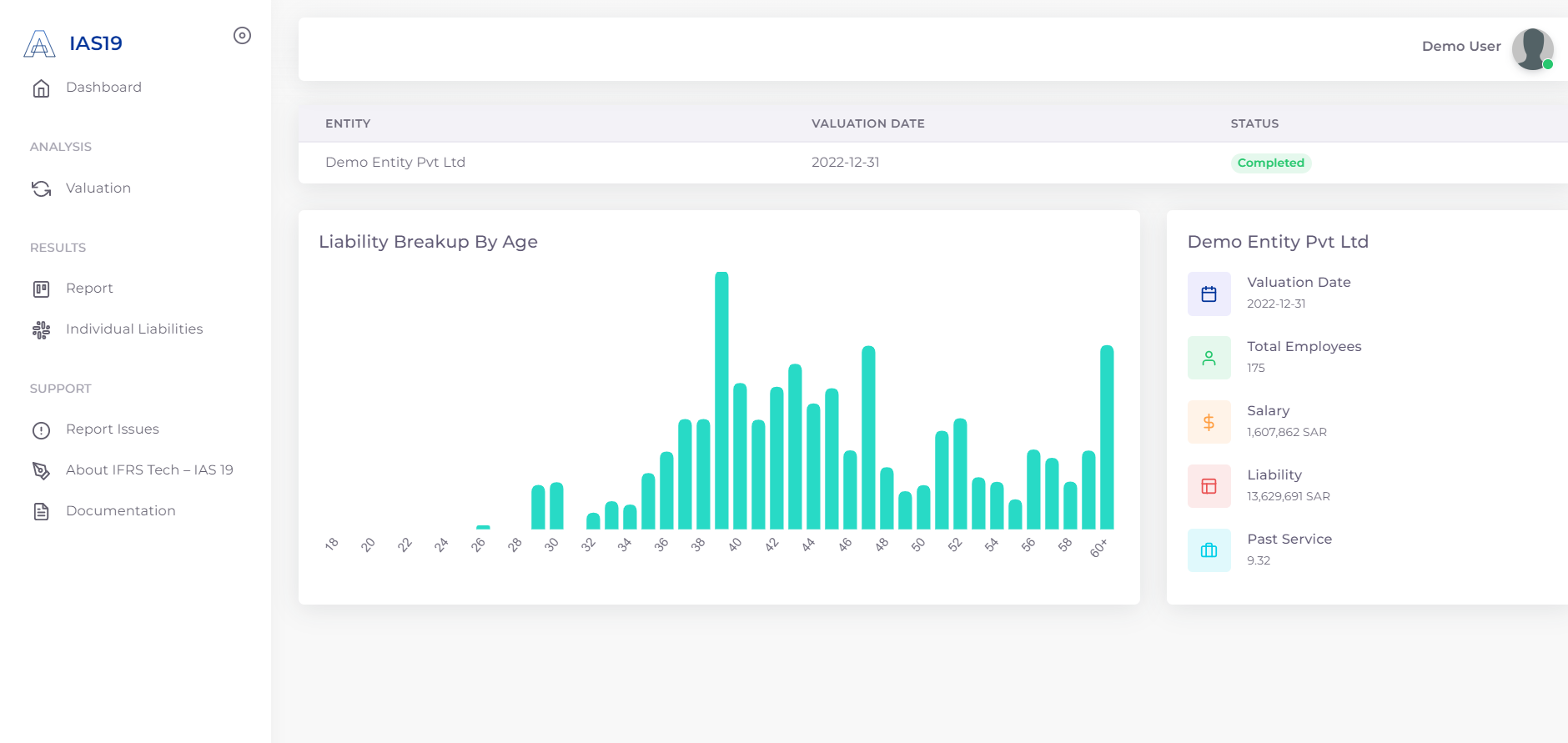

Actuarial valuation tool for IAS 19

IFRS Tech is proud to present an Actuarial Valuation Suite for carrying out actuarial valuations of Employee benefits inlcuding Gratuity, End of Service Benefits (EOSB) as per the requirements of IAS-19.

- Complete actuarial valuation with signed report.

- Automatic suggestion of assumptions based on demogrpahic profile.

- Generate instant reports without waiting for any third party consultant.

- Take control of your confidential employee data.

Our offering

Quick and easy to set-up, Comes with everything you need to get your valuation done!Support

Our product is backed by a team of qualified and proficient actuarial and accounting teams available just a call away to provide support required during the complete valuation process and audit.

Cloud Based

The platform is powered by Oracle Cloud Services based in KSA. This ensures that the system is compliant with Personal Data Protection Law (PDPL) issued by the Kingdom.

Secure

Our platform makes sure that your confidential employees data is for your eyes only. No need to send your private data to a third party outside consultant. All information stays with the data owners.

Our Pricing

Pricing is based on number of entities, and the total number of employees in your group.

Click here for free trialStandard Plan

- 1 valuation per year

- Unlimited re-runs

- Signed report

- Audit support

- 7/24 Support

Premium Plan

- 12 valuations per year

- Unlimited re-runs

- Signed report

- Audit support

- 7/24 Support

What We Do?

The service we offer is specifically designed to meet your needs.

Unlimited Re-runs

Instant Results

No Data Sharing

Year Experience

About us

Actuaries, Accountants andSoftware engineers.

We are a team of professionals with diversified experience in Actuarial, Risk, Finance, Accounting and Technology across different industries; merging to create synergy and value for the clients by offering one window solutions.

Frequently asked questions

If you don't see an answer to your question, you can send us an email from our contact form.

Actuarial valaution is an analysis performed by an actuary based on various long-term assumptions, such as discount rates, long term salary inrease rates etc. to project the expected cashflows and calculate the benefits value.

End of service benefit is a lumpsum settlement (gratuity) paid to an employee of a company on his/her resignation or termination. The rules of benefit vary across the middle-east region and are goverend by local labor law.

Projected unit credit method is an an actuaria valuation method presribed by the accounting standard IAS 19 for valuation of employee benefits. The method views each period of service as giving rise to additional unit of benefits attributable to an employee.

You can run your valuation on a specific date as many times as you want, using different financial assumptions such as the discount rate, salary increase rate. However, once a report has been finalized the results will be locked.

IAS 19 is an accounting standard prescribed by the International Financial Reporting Standards (IFRS) for accounting of employee benefits in exchange for the service rendered by an employee.

Employee benefit valuation is an actuarial valuation carried out by an actuary as per the accounting standard IAS 19 for valuation of employee benefits such as Gratuity, Pension, Post-retirement medical benefits, Long term leave, benevolent fund etc.

No! IAS 19 system has been designed keeping in view employee benefits all across the globle. All defined benefit plans, other than pension schemes, can be valued using this tool all across the world.

The valuation can take less than 5 mintues if you have your data template ready to go. The system first ensures that the data uploaded is correct and does not include any errors. Once the data checks are met, everything else is extremly quick.